The Pokagon Finance Board has made it a priority to provide on line financial education resources to citizens of all ages. To further that goal, we have added to our tribal website menu a separate landing page for these resources. Our objective is to overtime add financial education content that will help citizens navigate and educate themselves and their children/grandchildren on financial concepts and services.

See the links below for online financial education modules that you can take from the comfort of your home (you must register to access content, but registration and content is free):

| Chi Ishobak Online Financial Education Module | Keybank Native American Financial Services Center | Junior Achievement High School Financial Education Resources |

Providence First Trust Financial Literacy Course Outline

For more information visit: www.providencefirst.com or call 1-800-855-POKAGON

Tools:

Mortgage Calculators, Loan Calculators, Interest Calculators, Retirement Calculators, plus more! - Resources from Calculator.net

Per Capita Savings Plan

Pokagon citizens can create and preserve wealth with the Per Capita Savings Plan. Enrollment is now open for citizens who want to save and invest per capita payments on a tax-deferred basis. If you enroll in the plan during this open enrollment, deferral into the plan will begin with the first per capita payment in January 2022.

The plan is completely voluntary; you do not have to participate. Because this plan is optional, you must affirmatively make an election in writing to participate. This plan provides citizens with a voluntary option to defer all or just a portion of your monthly per capita payments until a future date. The money that is deferred is not taxed now; the taxes owed are deferred until the money is received. You will also be able to choose the length of the deferral and when you receive the money that you elect to defer.

Your election to defer your per capita only applies for one year. However, you may choose to automatically renew your enrollment so that your election to defer will remain in effect for subsequent years until modified.

4 Easy Steps to Enroll in Pokagon Per Capita Savings Plan

- Print form below (forms also provided at Administration Building front desk)

- Fill out sections 1–7

- Have form notarized by licensed notary (local bank or Administration Building)

- Mail form to address listed on bottom of form

NOTE: Direct all enrollment questions to our plan trustee Providence First at 1 (855) POKAGON.

5 Key Facts about the Per Capita Savings Plan

- Participation is completely voluntary and you can Defer 10-100% of your per capita amount (excluded from income tax you take out)

- You select the investment option and trustee invests the per capita contribution

- Minimum deferral period is five years (money grows tax-deferred for that period)

- You have the option to stop or start contributions annually

- Plan provides for emergencies

Ready to really dive in? Full details start below, and the enrollment form is attached at the bottom of the page.

Why participate?

Minimize taxes. There are no taxes owed on the amount deferred until the date you receive the money. You can choose to receive the deferred money in future years when you may have less taxable income or even spread it out over multiples years to minimize the taxes owed.

Tax-deferred growth. Since the taxes are not owed at the time of your deferral, the amount deferred has a larger pre-tax base, similar to a retirement account. Therefore, there is more money working for you and earning interest and investment gains for you.

Shielded from creditors. Money that is deferred is protected from your creditors.

Easy, efficient way to save money. This plan offers an easy way to save your per capita payments for a future date. This plan also provides for efficient management by professionals for institutional prices.

You have a choice in how you defer.

Amount you defer. You can choose a percentage (10% minimum) or a fixed dollar amount to defer.

Deferral period. The minimum deferral period is five years, but you can choose to defer your per capita payments for a longer amount of years, or until a specific future date, or until you reach a certain age.

Distribution method. You can choose to receive your deferred amount all in one lump sum or in installments over several months or years.

You also have the option to re-defer money that you have already deferred. You must make this re-deferral before the date you originally chose to receive the money. If your re-deferral is made in writing before the date you had elected to receive the money, you can re-defer it for another minimum of five years.

Your election cannot be changed.

Once you make an election to defer, you cannot change your election for that year’s per capita. You also cannot shorten the deferral period to receive your deferred money sooner. The only way that you can receive your deferred money earlier than you had elected or sooner than the minimum five-year deferral period is if you experience an “unforeseen emergency.”

What qualifies as an unforeseen emergency? An unforeseeable emergency is the only circumstance where money can be distributed earlier than the initial election. Unforeseen emergencies are defined as a severe financial hardship resulting from 1) an illness or accident (or of a spouse, beneficiary, or dependent); 2) the loss of property due to casualty; 3) the loss of a job due to termination, layoff or disability; or 4) any other similar extraordinary and unforeseeable circumstances arising as a result of events beyond your control.

Participation Restrictions. This plan is available to all enrolled members of the Band, however, you cannot participate in deferring your per capita payments if you owe child support or garnishment through a court order.

Deferred Account. Once you have deferred your per capita payments, it will be automatically withheld from your per capita payments and deposited into the plan. Your deferred money will then be invested as you have specified for the time you elected. You will receive quarterly statements reporting your balance, contributions, distributions, and investment gains/losses.

Then, at the future date you have specified, you will begin to receive your deferred money in the method you chose (for example, monthly, annually, lump sum, etc.). When the money is distributed to you, it is taxable income so it will have mandatory federal tax withheld.

You have a variety of investment options.

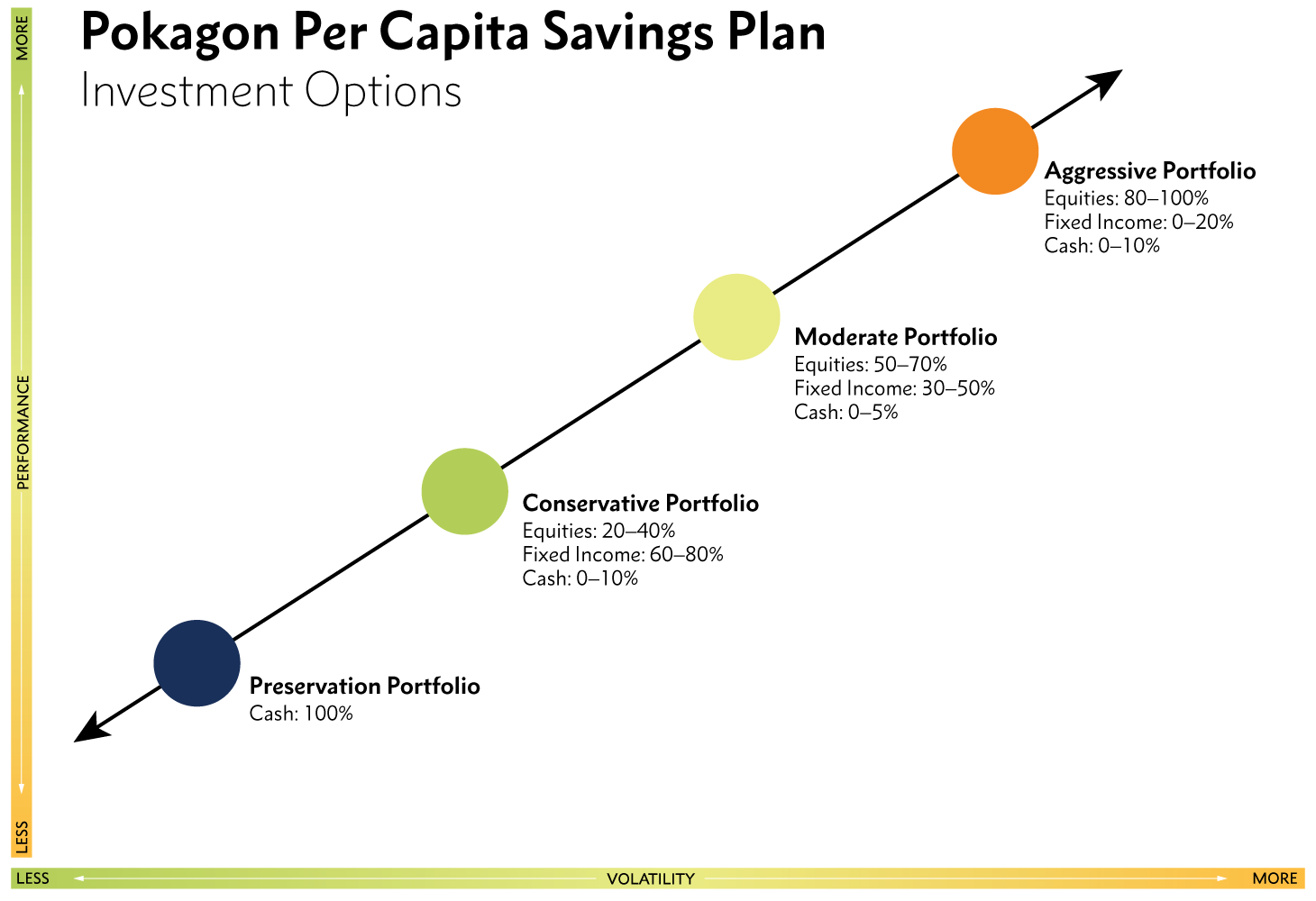

The Band created an Investment Policy Statement for the Plan for prudent investment of these funds. Everyone who participates in the plan will have the option to select their investment objective (and accompanying level of risk) from the models shown. You can change your selection quarterly if desired. The investment models are:

| Conservative | Moderate | Aggressive |

| Equities: 20-40% | Equities: 50-70% | Equities: 80-100% |

| Fixed Income: 60-80% | Fixed Income: 30-50% | Fixed Income: 0-20% |

| Cash: 0-10% | Cash: 0-10% | Cash: 0-10% |

There is also the option to elect to have your funds placed in a Preservation Portfolio that will be 100% held in a money market account. Initially, the plan will be invested in Vanguard funds that are highly rated and provide diversification for low costs.

You can designate a beneficiary.

When you enroll in the plan, you will have the option of designating a beneficiary. In the event of your death, your designated beneficiary would receive any funds in the plan that had not yet been distributed to you. If you do not designate a beneficiary, the funds would be distributed subject to an order of succession of family members.

Creditors and Your Trust Assets. The money that you have deferred will be held in trust until your elected distribution date. Until that time, the deferred money is not subject to individual creditors or garnishment or attachment. Also, the deferred money cannot be assigned, pledged as collateral, or encumbered.

Background on the Trust Administrator. Providence First Trust Company (PFTC) has been chosen to manage the Voluntary Adult Deferred Per Capita Plan and will handle all the accounting, statements, taxes, contributions, distributions, and investments. PFTC has been the Agent handling the administration on the Minors Trust since its inception. PFTC is an independent trust company that specializes in Native American per capita trusts. They are recognized market leaders, currently administering 25 other similar Native American per capita trusts with more than $3 billion in trust assets. PFTC customizes its services to fit the needs and circumstances of these Native American communities and their 35,000 beneficiaries and families. Its officers are experts in the specific laws and tax regulations pertaining to these trusts and our database is specifically built for the enrollment and accounting data of these trusts. When you call PFTC, you will speak directly to its staff that exclusively works with Native American parents and children. Their offices are located on the reservation of the Salt River Pima-Maricopa Indian Community in Scottsdale, Arizona.

Plan Expenses. The plan expenses consist of the Trustee fees which will be disclosed on your statements. The Trustee receives an annual investment management fee of 0.55% that is netted against investment returns. The Trustee also receives an annual administrative fee of $36 per plan Participant that the Band has committed to pay for the first three years to encourage enrollment in the plan.

You may contact Providence First Trust at any time with questions related to the plan.

8840 E. Chaparral Road, Suite 250

Scottsdale, AZ 85250

(602) 952-2300 phone

1-855-POKAGON toll-free

pokagon@providencefirst.com

(602) 952-0018 fax