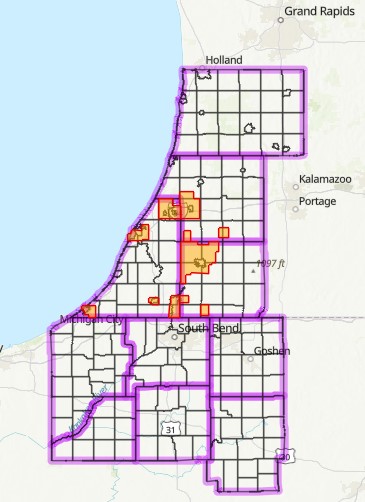

Check out our new interactive tax agreement locator

Citizens may now use our new online, interactive map tool to determine if an address sits inside or outside of the tax agreement area. This map also outlines the ten county service area and the tax boundary township, as well as marks the tax exempt gas stations and Pokégnek Édawat villages.

Resident Tribal Member

As part of the Tax Agreement Between the Pokagon Band of Potawatomi Indians and the State of Michigan, a Pokagon Band citizen may qualify for certain exemptions from some Michigan taxes if the tribal citizen is a Resident Tribal Member (RTM). RTM refers to those citizens whose principal place of residence is within their own Tribe’s negotiated “Agreement Area” and who have been added to the official RTM list maintained at the State of Michigan.

All citizens ages 14 and older who live in the Agreement Area will automatically be added to the active RTM list at the State of Michigan by the Pokagon Band Finance Department. This qualifies the RTM to utilize the available tax exemptions when required guidelines are followed. A pre-application is no longer required.

To remain on the list of Active RTMs, it is critical that the RTM maintain a current physical address on file with the Pokagon Band Enrollment Department. The physical address should be the address of the primary permanent residence of the RTM. This address must also be a deliverable address. RTMs will remain on the list at the State and remain eligible for the Tax Agreement RTM benefits until they either move out of the Tax Agreement Area or they cannot be reached to update their address if it becomes undeliverable. In these instances, the citizen’s RTM status will be deactivated both at the Tribe and at the State of Michigan.

For more information, please contact Julie Rodriguez at Julie.Rodriguez@PokagonBand-nsn.gov or (269) 462-4211.

Request for Sales Tax Exemption for Vehicle Purchase

Tax Exempt Gas Stations

Tribal citizens can make tax exempt fuel purchases at the following gas stations: The Bent Tree Market near Four Winds Dowagiac, the Benton Harbor Marathon, the Hartford Citgo on Main Street, the Keeler Super Store Gas Station in Hartford, and the Edwardsburg Marathon.

Citizens may use their tribal card and pay at the pump. The only exceptions should be if the station attendant informs you that the system is down or that your card is not working when they attempt to scan it. In these situations, please fax your receipts and a copy of your card to (269) 782-6882 or email them to StateTax@Pokagonband-nsn.gov or bring them to the finance dept in the administration building or mail them to Finance, 58620 Sink Rd, Dowagiac, MI 49047 within 30 days for reimbursement. The reimbursement will be added to your monthly per cap payment (and it won’t be taxed). Please be sure to write your enrollment number and sign your name on each receipt submitted.

If you lose your enrollment card, please contact the enrollment office to request a new one at (269) 782-1763. Once you receive a new card your old card will be deactivated.

Tax Agreement Documents

The first is an overview of the Tax Agreement written by the Pokagon Band. The links are to the official tax agreement between the Pokagon Band of Potawatomi and the State of Michigan, and three amendments to the Tax Agreement, from the Michigan Department of Treasury.